Who’s included

PIs, EMIs, and credit institutions regulated by the CBI

How to file

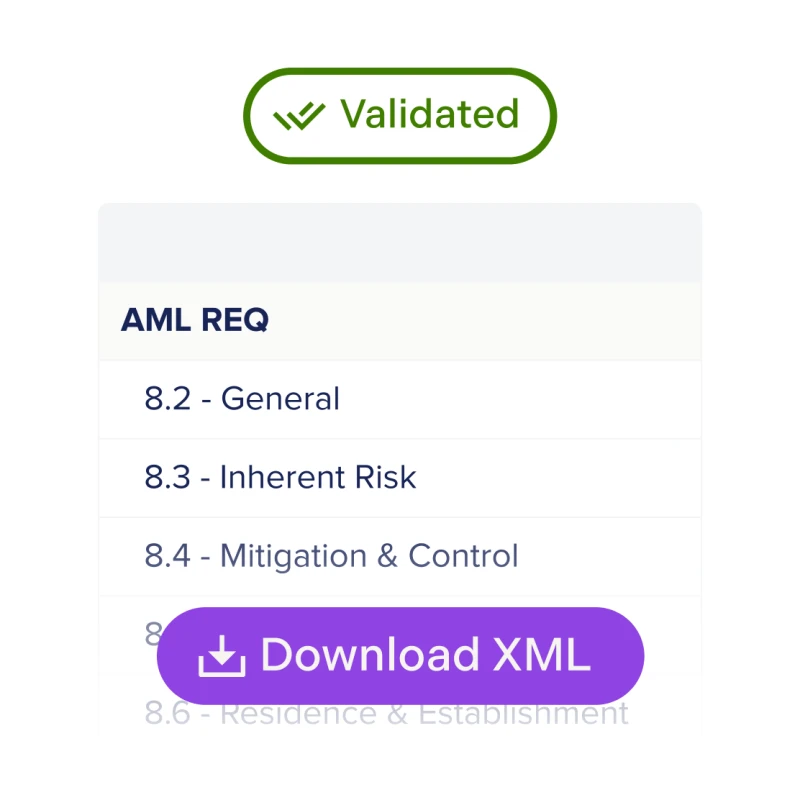

XML submissions validated against regulator schemas

When it’s due

Dry run opens: November 2025

Submissions: February 2026

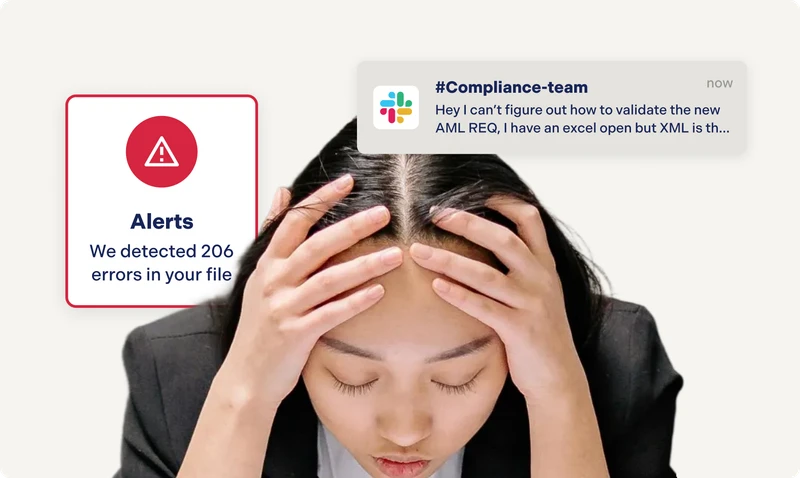

Without Complyfirst

Endless Excel work – manual data pulls from multiple systems

Hunting for guidance – Schemas and guidance buried across docs

No real-time validation – errors only surface after portal upload

Double the work – proprietary vendor files don’t match CBI, doubling work

Manual chasing – email chains delay sign-off and cause version confusion

Weak governance – unclear approvals and no audit trail

Deadline-day stress – left without expert support when it matters most

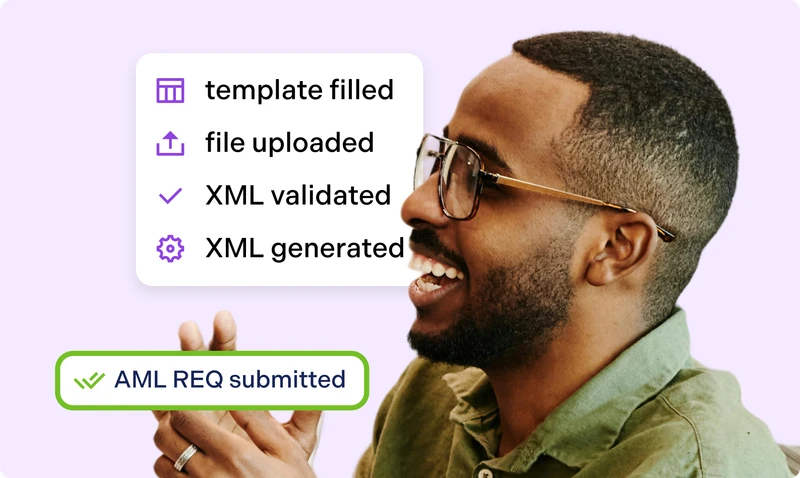

With Complyfirst

Map your data once – data extracts flow straight into the right fields

In-platform guidance – rules, schemas, and definitions built-in

Real-time validation – errors flagged instantly and fixed before upload

Eliminate double work – no proprietary files, no duplicate effort

Easy collaboration – workflows with tasks and reminders keep teams on track

Strong governance - approvals and audit trail ready for regulators

1:1 expert support – live troubleshooting, even on deadline day

Trusted by the best in fintech

AML REQ 2026 and beyond - all requirements covered.

Complyfirst is built to handle today’s CBI AML REQ return and tomorrow’s compliance obligations, in Ireland and across multiple jurisdictions.

AML REQ ready

Practical support for November 2025 dry runs ahead of CBI filing deadlines.

CBI-wide coverage

One platform for AML REQ plus every other Central Bank of Ireland return.

Beyond Ireland

Extend the same reporting workflow across EU, UK, and global filings.

Proven results from compliance leaders

What truly sets Complyfirst apart is its ability to simulate a regulator’s review, identifying potential data discrepancies or inconsistencies across reports before submission.

Pamela Crilly, EU COO, TrueLayer , TrueLayer

Already have a vendor?

No problem. You can still run your AML REQ test with Complyfirst during the CBI cycle. If you decide to switch later, we’ll credit your first-year fees so you’re never paying twice.

Your quickstart guide to the CBI AML REQ

Navigate the tabs below to learn everything you need to know about preparing and submitting the new AML REQ return.

AML REQ overview: what changed and why it matters

How to actually complete your AML REQ & practical steps to comply

Report to the CBI, hassle-free

Secure your free AML REQ test submission with full access to Complyfirst and 1:1 expert support. No contracts, no risk.

Full platform access – prepare, approve and submit AML REQ in one place

Expert support – 1:1 expert support when you need it, even on deadline day

Zero obligation – proof it works before you commit