Get repetitive compliance to-do’s done faster.

Automate the repetitive copy-paste work behind reporting, reviews, and investigations, while keeping the expert decisions with your team.

Trusted by PIs, EMIs, challenger banks, and fast-growing fintechs

Your smartest people are trapped in mind-numbing work.

Compliance teams aren’t drowning in risk. They’re drowning in repetition.Copy → Paste → Check → Repeat. It never ends.

This is where Complyfirst comes in.

We automate the repetitive tasks in your compliance workflow, helping teams move from doing to reviewing.

We only build workflows that deliver 80%+ automation.

If it doesn’t meaningfully reduce your team’s workload, we won’t build it.We’re not an AML/KYC vendor.

We plug into these systems to power your workflows.

We’re not a generic GRC platform.

We focus only on automating GRC processes in financial services.

We’re not a cookie-cutter AI solution.

Every workflow is built around your specific processes.

Regulators, regulations, and reports we work with

Our step-by-step process

We handle the full implementation (no engineering required from your side), with fast 1:1 support.

We learn your workflow.

We sit down with your team to understand how the process runs today. Every search they do, every check they run, the policies, templates, and the approvals required. From one compliance professional to another.

We identify the repetitive work.

The copy-paste between Excel, the back-and-forth emails, the formatting. All the tasks that steal time but don’t require expertise.

We turn that into a custom AI workflow.

We write the prompts, structure the workflow, and automate the repetitive steps based on your processes, policies, and regulatory requirements, while your experts keep the judgement calls exactly where they belong.Get started with a ready-to-use workflow

Deploy pre-built workflows, fully customisable to your processes and policies.

File required regulatory returns

Automate data collection, validation, and report generation for every regulator you file with.

Investigate and submit SARs

Speed up investigations, run checks automatically, and generate consistent SAR case narratives for review.

Run tests & draft audit reports

Pull evidence together, run tests across your data, and produce structured audit report aligned with your template.

Track fintech partner compliance

Centralise partner data and generate oversight reports across SARs, fraud, complaints, and AML risks.

Manage fraud cases

Read inbound fraud reports, extract key details, and draft suggested responses or next actions for analysts.

Custom compliance dashboards

Centralise data across teams and systems. Highlight risks, track KPI’s, and auto-generate reports instantly.

Whatever format your data lives in, we can work with it.

Success Stories

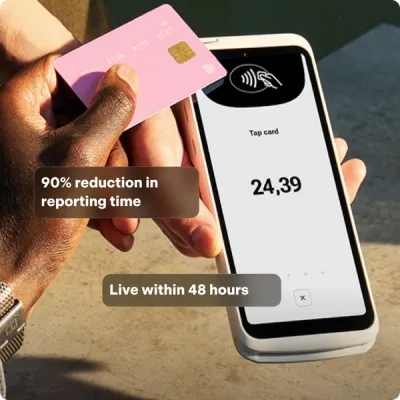

“What used to take weeks was fixed in hours with Complyfirst. We were live, errors resolved, and submitted within 48 hours.”

Adrian Witkowski, Head of Regulatory Reporting, SumUp

“What sets Complyfirst apart is its ability to simulate a regulator’s review, identifying discrepancies before the actual submission.”

Pamela Crilly, EU COO, TrueLayer

"I’ve worked at large banks with entire teams managing returns. With Complyfirst, we had it done in days."

Neil McDermott, Chief Financial Officer - Decta Limited, Decta

Designed for trust and control

ISO 27001 compliant

We follow ISO 27001 standards to keep your data safe and in line with what regulators recognise and trust.

AI that stays factual

Inputs are yours. Outputs are yours. The AI is trained only on your knowledge base and regulations.

EU data residency

Your information remains in EU-based centres, aligned with EU privacy standards.