Trusted by PIs, EMIs, challenger banks, and fast-growing fintechs

Reporting still runs on spreadsheets.

Reports are built across disconnected systems, passed between teams, and stitched together under tight deadlines. And the cycle never ends.

This is where Complyfirst comes in.

We automate the repetitive work behind your regulatory, tax, and internal reporting, all in one place.

Not another “last-mile” reporting tool.

Complyfirst is different to the basic Excel to XML/XBRL template converters you’re used to.

Not just a “template converter”

We automate the full reporting workflow. From data collection to validation to submission.

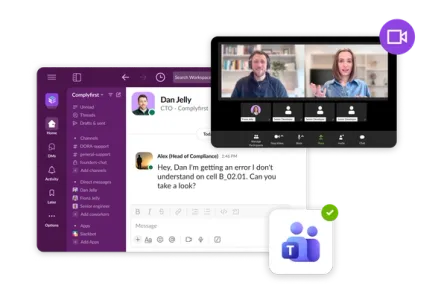

Fast 1:1 support

DM us on Teams, Slack or Zoom, and get a response in <1 hour (yes, even on deadline day).

All your reports. One place.

Launch, scale, and report in every jurisdiction from a single platform.

Our step-by-step process for any report

Tell us what reports you need.

Regulatory, tax, internal, qualitative, quantitative. There’s no report we can’t handle. We sit down with your team to understand how your processes run today. Every search they do, every check they run, the policies, templates, and the approvals required.

Hands-on onboarding.

We implement the full reporting process, end to end. We map your data, build your reporting workflow, and automate the repetitive steps based on your processes, policies, and regulatory requirements, while your experts keep the judgement calls exactly where they belong.

Go live with 1:1 support.

DM us on Teams, Slack or Zoom, and get a response in under an hour (yes, even on deadline day). We stay hands-on and guide you through regulatory deadlines and changes. We don’t disappear after go-live.

Across regulators, regulations, and reports

Get started with a ready-to-use reporting workflow

Deploy pre-built reporting workflows, fully customisable to your processes and policies.

File required regulatory returns

Automate data collection, validation, and report generation for every regulator you file with.

Investigate and submit SARs

Speed up investigations, run checks automatically, and generate consistent SAR case narratives for review.

Run tests & draft audit reports

Pull evidence together, run tests across your data, and produce structured audit report aligned with your template.

Track fintech partner compliance

Centralise partner data and generate oversight reports across SARs, fraud, complaints, and AML risks.

Manage fraud cases

Read inbound fraud reports, extract key details, and draft suggested responses or next actions for analysts.

Custom compliance dashboards

Centralise data across teams and systems. Highlight risks, track KPI’s, and auto-generate reports instantly.

Whatever format your data lives in, we can work with it.

Your data can live anywhere. Excel spreadsheets, PDFs, chat logs, Amazon feeds, APIs and we can work with it. You don’t need engineering resources to get started. Just upload a file and you’re off.

We fit your existing workflow

No rip-and-replace

No forced formats

Your win is our win.

Your success is the only metric we care about, and the numbers speak for themselves.

90% less reporting effort

SumUp was onboarded, validated, and live on Complyfirst within 48 hours.

50% less reporting effort

DORA was submitted within 24 hours.

<24hr time to go live

Decta submitted clean regulatory returns with 0 issues or rework.

Designed for trust and control

ISO 27001 compliant

We follow ISO 27001 standards to keep your data safe and in line with what regulators recognise and trust.

AI that stays factual

Inputs are yours. Outputs are yours. The AI is trained only on your knowledge base and regulations.

EU data residency

Your information remains in EU-based centres, aligned with EU privacy standards.