At A Glance: FCA Dear CEO Letter to Payment and E-Money Firms

What’s New?

On 16 March 2023, the FCA wrote a Dear CEO letter to Payment and e-Money firms highlighting deficiencies and concerns with the sector and the need for firms to take action.

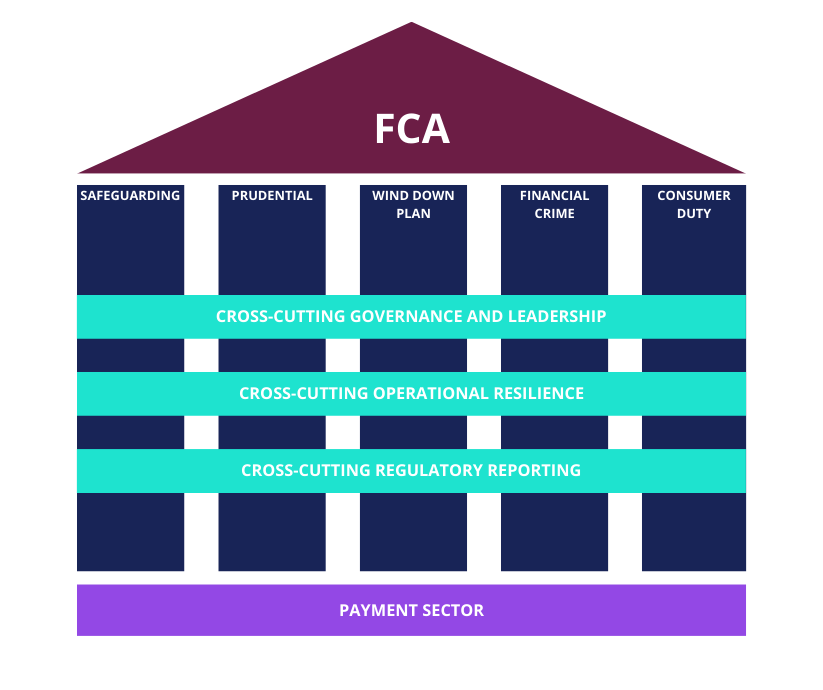

The FCA wants to see three key outcomes:

- That customers’ money is safe.

- That firms don’t compromise financial system integrity.

- That firms meet customer needs by providing high-quality products and services and implementing the Consumer Duty.

The FCA also highlight three cross-cutting priorities for 2023:

- Governance and Leadership

- Regulatory Reporting

- Operational resilience

What Does This Mean?

Safeguarding

The FCA is laser-focused on reducing the harm that arises from firm failure. They want to see robust safeguarding arrangements, including documented processes for identifying “relevant funds” for safeguarding, daily reconciliations to ensure correct sums are protected, and bank safeguarding acknowledgement letters on file.

The FCA also reminds firms that are required to have a statutory audit to appoint an auditor for safeguarding and to ensure that the FCA is made aware of any adverse findings or non-compliance.

Prudential

The FCA stresses the need for firms to improve prudential risk management. They remind firms that they need to meet regulatory capital requirements at all times and to plan well ahead to ensure that they have adequate financial resources on an ongoing basis.

Wind-Down Planning

The FCA has found that many companies have not created wind-down plans or have created poorly drafted plans that don’t provide sufficient detail on triggers, practical steps, and the costs of winding down. Firms need to get grips with wind-down planning asap.

Financial Crime

The FCA noted increased evidence of financial crime in the sector and reminds firms of their obligations in relation to AML, fraud, and sanctions.

The FCA also suggest that fraud could increase due to the cost-of-living crisis and they emphasise the need for firms to review and address weaknesses in their fraud systems and to maintain strong due diligence controls.

Consumer Duty

In preparation for the incoming Consumer Duty, the FCA remarks that they continue to see examples of firms not acting in the customer’s best interest. The FCA reminds firms of their need to comply with the Duty and ensure good outcomes for customers.

Cross-Cutting Priorities

The FCA notes that issues such as governance and leadership, including lack of experienced personnel and meaningful due diligence could be contributing to a lot of the regulatory issues in the sector.

They remind firms of the importance of undertaking due diligence on their directors and agents/distributors, building out their Operational Resilience and ensuring that they submit accurate and timely Regulatory Reports or face fines or enforcement action.

What Does This Mean For Your Business?

Safeguarding remains a top priority for the FCA and they will continue to scrutinise safeguarding arrangements. You need to ensure you have a documented approach to safeguarding that is line with the PSRs/EMRs and that you complete thorough safeguarding reconciliations every day.

If you’re one of the firms required to have a safeguarding audit, you must appoint an auditor and ensure that any safeguarding breaches are reported to the FCA straight away.

Financial crime is consistently on the FCA’s radar. You should review your AML, sanctions, and fraud measures to ensure they remain effective.

Wind-down planning has been done poorly thus far. Get working on evolving your plans, focusing on trigger points and actions to be taken.

Get clear on the requirements of the new Consumer Duty and ensure you’re ready to meet the July 2023 implementation deadline.

Review and improve your regulatory reporting processes. Regulatory reports are submitted to the FCA via RegData and are a key tool for supervision. If you submit late or inaccurate reports, be prepared to face fines or disciplinary action.

How Can You Keep The FCA Happy?

With a laundry list of regulatory requirements, the FCA expects a lot from you. With so much to grapple with, it makes sense to automate some of these tasks right away. Why not start with automating your FCA regulatory reporting? It’s a cross-cutting priority for the FCA and one that you need to nail every time.

ComplyFirst’s platform can help by collecting your regulatory data, applying logic from the FCA rulebooks, and validating and submitting your reports to the FCA RegData platform. Simple and effective, it’ll save you time and money and mean you’ve one less thing to worry about. To find out more, book a 30-minute session with our founder, and financial regulation nerd, Fiona Jelly.

Limited to 5 places per month!