FCA Consumer Duty Summary + 10 Tips for Implementation

The Financial Conduct Authority’s (FCA) new Consumer Duty marks a huge shift in the financial regulatory landscape, ushering in new consumer-centric standards. The duty requires firms to put their customer’s needs first and to weave the Consumer Duty into the operational fabric of their business.

In this blog, we’ll cover the key aspects of the Duty and provide 10 practical tips for implementation. If you’re a busy exec or compliance professional, you’ll find a clear road map here that helps you understand and rise to this latest regulatory challenge.

First things, first, what is the FCA Consumer Duty?

The Consumer Duty sets higher, clearer standards of consumer protection across financial services, and requires firms to put customers’ needs first. The Duty comes into force for new and existing products and services on 31 July 2023 and for closed products and services, it’s 31 July 2024. You can read more about it in the FCA’s Final Guidance Document.

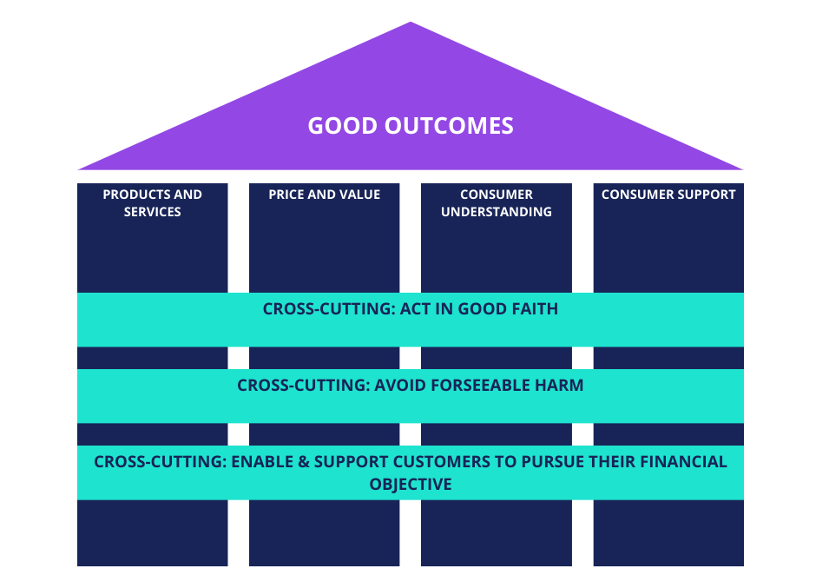

We find it helpful to think of the Consumer Duty as a structure – a house, if you will. The FCA has set out four foundational pillars: products and services, price and value, consumer understanding, and customer support. These pillars are braced by three cross-cutting rules, or “rafters,” as we’ll call them, requiring firms to act in good faith, prevent foreseeable harm, and enable customers to achieve their financial objectives. Linking all these components is the “roof” of good consumer outcomes, protecting both consumers and firms from potential harm.

Here’s how it looks.

Kind of like a house, right?

Now you’re probably thinking: how do I build this “house”? Or how do I ensure my “house” is built on solid foundations? We’ll now outline the 10 actionable tips to help you build a Consumer Duty structure within your organisation, setting you on the path to compliance.

10 tips for building Consumer Duty into your operations.

- There’s no need to start from scratch: The Duty should document your existing practices, not invent them from scratch.

- Allocate responsibilities: It’s important to distribute the Duty between the first line (business units), the second line (compliance function), and the Board. Documenting who’s responsible for what will ensure cracks don’t appear in your foundations.

- Pick Your Consumer Duty Champion: Appoint a single ‘Consumer duty champion’ at the Board level to steer your firm’s consumer protection efforts.

- Identify your Target Market: Get crystal clear on who your customers are and their needs, characteristics, and objectives. Document your customer’s persona, as this will provide a life-like customer avatar for you to reference. Otherwise, how will you know how best to serve them?

- Define what “good” outcomes look like: Once you’ve identified your target market, you need to figure out what “good outcomes” looks like to them and accordingly wrap your offering around their needs.

- Complete a Fair Value Assessment: The Duty requires that products and services provide “fair value” to consumers. Consider benchmarking yourself against competitors, reviewing your profit margins, and examining the benefits and limitations of your products and services.

- Monitor Your Products and Services: Regular monitoring of products and services is key to ensuring you’re delivering positive outcomes for consumers. Consider metrics like customer satisfaction, customer complaints, response times and customer churn.

- Ensure Product Governance: Consider implementing a product or service approval form to ensure that new products and services (or changes to existing ones) are fully thought through, including potential risks to consumers, with mitigations put in place.

- Leverage data: There are tons of data points you could consider. Document your firm’s data monitoring strategy and systematically gather the data that’s important to your firm. Consider customer surveys, complaints, response times, downtime of your online services, trend analysis and so on.

- Collaborate, collaborate, collaborate: Collaboration will be vital to satisfying the Duty. The first line (business and product teams), second line (compliance and audit teams) and the Board should work in harmony to ensure good outcomes, addressing any issues identified and documenting the steps taken to ensure compliance with supporting evidence.

Conclusion: Stay ahead with Complyfirst

We’re a regulatory technology company comprised of ex-bankers, lawyers and tech experts specialising in the payments and e-money sectors. We provide regulatory compliance software designed to tackle challenges and deliver customized compliance solutions for our clients’ success.

How can we help with Consumer Duty?

Complyfirst offers an affordable “done-with-you” service to help your firm get ready for the Consumer Duty. We provide you with valuable resources that we call our Consumer Duty Framework. It includes a comprehensive 1-hour webinar led by a compliance specialist, step-by-step instructions on implementing the new rules, a user-friendly self-assessment tool, and DIY templates that you can tailor to your business needs. Our service culminates with a compliance expert reviewing your implementation plan to ensure you’re on the right path.

As part of our commitment to help firms in preparing for the Consumer Duty, our Consumer Duty Framework and DIY templates are FREE to access! Click the button below to get your free templates!